Most Indian Households prefer bank deposits/cash to park their savings – 66% of household savings are sitting in deposits/ cash.

What about the recent increase in demat accounts? As per recent reports, the number of demat- accounts jumped from 4 Crore to 6 Crore since Feb 2020.

The demat numbers hide more than what they reveal – The Assets Under Management (AUM) in the equity market for India is 5% compared to the global average of 34%. In other words, equity participation is still quite low in India. The preference is for deposits, real estate and Gold.

Historical Nominal and Real Asset Returns in India is an amazing paper on historical returns written by Rajan Raju. Thank you Rajan!

Inflation will eat your lunch

India is an inflationary market – the most fundamental takeaway is that nominal returns are meaningless in India. All asset classes are severely affected by inflation.

If you kept a $100 note under your bed for the last 25 years, it would increase in value against the Indian Rupee. The $100 note was worth around INR 3000 in 1995 (USD 1 = 30 INR) and is now worth INR 7500 (USD1 =INR 75)!!

In nominal terms the $100 note gives you INR 7500. However, the value of INR 7500 is significantly lower in 2021 than it was in 1995. Assuming an inflation rate of 6% per year, the INR 7500 is worth only INR 1700. The $100 note has eroded in value because of inflation.

The rest of the article – talks only about real returns. (after adjusting for inflation)

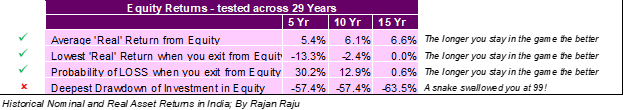

A game of snake and ladder

A typical game of snake and ladder has two characteristics –

- A long term bias i.e. a higher possibility of winning as the number of dice rolls increase.

- The possibility of a steep fall (down the throat of a long snake).

The stock market (Index) mirrors these qualities. The longer you stay in the market, higher the chances of a positive return. To be specific, the probability of a negative real return declines from 30% to 0.6% as we go from an investment horizon of 5 years to 15 years!

So can we just invest it and forget? Not exactly. The results from Rajan’s paper indicate that there is significant sequence risk in the stock market. There can be deep drawdowns (up to 60% loss from the peak) which last for long durations (up to 5 years). This can be devastating for a retirement portfolio, just when you are preparing to ride into the sunset.

Leaving the game at 99

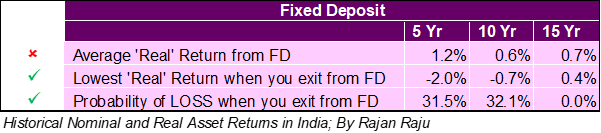

When you are planning to retire, the prospect of a snake lurking in the corner to swallow your returns can be unsettling. Retirees usually shift their allocation to less risky assets with a steady income.

Enter the mighty Fixed Deposit (FD). Historically, the Fixed deposit returns have been able hold their value against inflation. In other words, INR 100 in an FD after 15 years has zero real return – BUT your capital is safe and sound. There is no snake to swallow you. (I have ignored the risk of a bank default for this comparison)

IF – the FD’s continue to keep pace with inflation, how would they serve as a retirement instrument?

Let us assume a pot of INR 100 Lacs. The FD has a return of 6% (same as inflation)

If you need an annual income of INR 4 Lacs from the pot.

Year 1: You would draw 4% of the pot. That would leave the pot at INR 102 Lacs.

Year 2: You would draw 4.16% of the pot (6% increase to account for inflationary prices). That would leave the pot at INR 103.9 Lacs.

Year 26: You would draw 70.67% of the pot (6% increase to account for inflationary prices). That would leave the pot at INR 8.6 Lacs!

A retiree who places all his capital in FD and consumes 4% of his pot – will be able to live for 25 years on his savings with no decline in purchasing power.