Introduction

India’s farming story has changed a lot in the last 60 years. Fertilizers played a big role in that change. And Chambal Fertilizers, one of the country’s biggest fertilizer makers, has grown by riding this wave.

Let’s look at how India’s need for fertilizers has grown — and how Chambal built a strong business by meeting that demand.

The Start: India’s Green Revolution

In the 1960s, India needed more food. The government pushed for a change. New high-yield crops were introduced, but these crops needed more nutrients to grow. So, chemical fertilizers became a must.

- In the 1970s, farmers got about 13.4 kg of grain for every 1 kg of fertilizer.

- But over time, that number dropped to just 3–4 kg. Why? Too much use of nitrogen, poor soil health, and not enough use of other key nutrients like phosphorus and potassium.

More Water, More Fertilizer

Irrigation also played a big part. When farmers had more water, they used more fertilizer. From 2016 to 2021, the land under irrigation went from 49.3% to 55%.

This matters because:

- Crops with regular water use fertilizers better.

- So, when irrigation spreads, fertilizer use rises too.

The Main Driver Today: Government Subsidies

The biggest reason fertilizers are used so much today? Government help.

- In 2025–26, the Indian government set aside ₹1.84 trillion to keep fertilizer prices low.

- ₹1.19 trillion is just for urea — which Chambal makes.

- ₹0.49 trillion goes to other fertilizers like DAP and MOP.

These subsidies cover most of the cost, so farmers only pay a small part. This makes fertilizers affordable — and often overused.

Chambal’s Business Model: Built on Subsidies

Chambal Fertilizers has shaped its business around these subsidies. Here’s how it works:

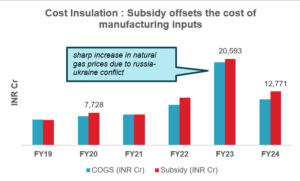

- Government Pays Most of the Cost

Chambal sells fertilizers at low prices, and then gets paid by the government later. Almost the entire cost of making fertilizers is covered this way.

Source: Annual Reports

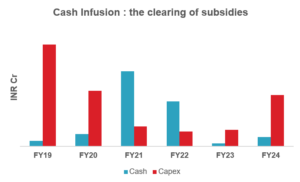

- Cash Flow Depends on Government Payments

There’s a catch. The company gets money after the sale, sometimes after a long delay. This delay can hurt cash flow.

But recently, the government cleared old dues, which helped Chambal’s cash situation. This allowed the company to plan new expansion (capex).

Source: Annual Reports

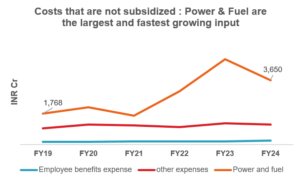

- Profits Come From Managing Other Costs

Chambal can’t raise prices — the government sets them. So, to make profits, it needs to manage other costs well.

- Recently, power and fuel prices went up, putting pressure on profits.

- So, Chambal’s future depends on keeping its costs low and efficient.

Source: Annual Reports

⚠️ What Can Go Wrong?

While the model works now, it’s not without risks:

- If the government delays payments, cash flow suffers.

- If input costs rise, but subsidies don’t increase, margins fall.

- If the subsidy system changes, Chambal’s whole model may need to change.

For example, the government may move to Direct Benefit Transfers (DBT), where farmers get the money directly, not the companies.

Final Thoughts

Chambal Fertilizers shows how a business can grow with smart policy alignment. The company has built its model on India’s rising fertilizer demand and government support.

It is now at a turning point — with recent cash flow improvements and plans to expand. But it must also be ready to adapt if subsidy systems or costs change.

In a country where food security is a top goal, Chambal will remain a key player — as long as it can stay lean, responsive, and focused on efficiency.