Introduction

VST Industries is one of India’s oldest cigarette makers. It sells well-known brands like Charms, Charminar, and Total. Though it’s not as big as ITC, VST still holds a solid 7–8% market share in India’s cigarette space.

Its strength? A loyal customer base and deep roots in southern India. It’s the No. 2 player in a tough, high-barrier market.

Excise duty

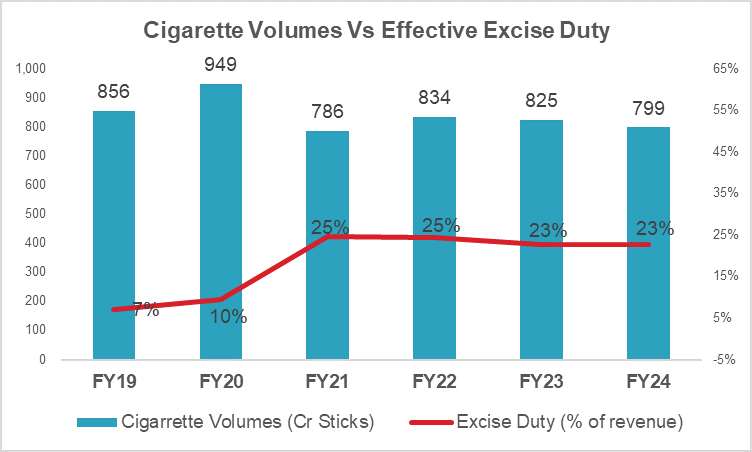

Every year, the government raises excise duty on cigarettes. This is a tax charged on each stick. When this tax goes up, the price does too — and people smoke less.

Source: Annual Reports

The drop in volumes in FY21 coincide with a steep increase in the excise duty regime on tobacco products.

Pricing power

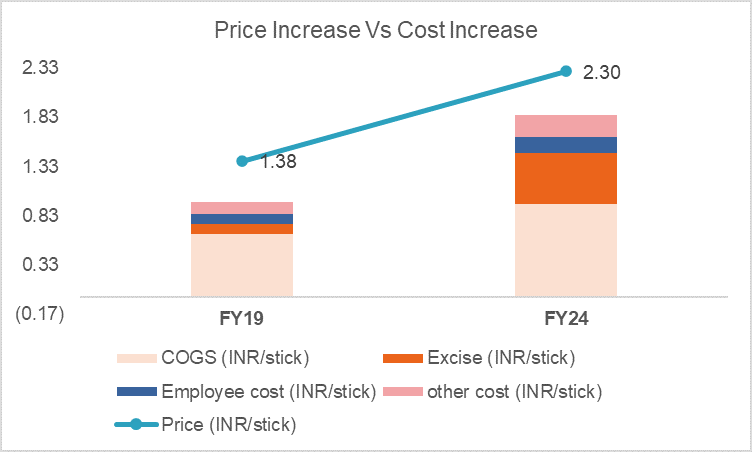

VST has pricing power. Even when costs go up, they can raise prices without losing too many customers. In fact, VST has been increasing prices to cover excise duty and raw material increases for the last 5 years. Brand loyalty runs deep, and customer stickiness is evident.

Source: Annual Reports

Investment drive

VST is not sitting still. It’s investing in its future. The company has made big capex investments. This includes converting the leasehold land into freehold and technological upgrades in the factory. VST is a brand-led business, and it invests heavily in marketing and distribution.

Steady cashflows

One of VST’s strongest traits is its Free Cash Flow to Firm (FCFF). It consistently generates ~150 Cr of FCFF. This is also the FCFE because the company has no debt. Most of this cash is returned as dividends to the investors.

The Final Puff

In a shrinking market with heavy taxes, VST plays smart. It has strong brands, pricing power, and a clean balance sheet. While volumes may not grow fast, profits and cash flows stay solid.